How Fintech Is Drawing New Investors Into Emerging Markets

The gradual domination of Fintech in today’s globalized economy can be accounted for by various institutions.

There is no denying the fact that a Fintech innovation is taking place all around the world. In markets where the financial system is not “traditional”, these new innovations are extremely impactful and enable the financial system to be reached by a significant amount of individuals.

As the Fintech landscape continues to boom globally, one region has emerged as its future: Africa. Africa, home to the majority of the world’s unbanked populations, is also home to a plethora of new Fintech startups that have come to completely redefine how money, investments and credit are dealt with across the continent — and foreign investors have taken notice.

This rising prominence of Africa’s Fintech space recently prompted United Kingdom Prime Minister Theresa May to take an envoy of investors and advisors to Kenya, South Africa, and Nigeria to solidify business partnerships on the ground. May’s Ambassador for Fintech Alastair Lukies commented, “Our ability to partner with African nations, to create modern day platforms that level the playing field and enable hundreds of millions of consumers to trade their way into a better life, can never be underestimated.”

The rise in Fintech in Africa coincides with the rise of socially-minded investment trends — in recent years, impact investing has become a field of its own. In Morgan Stanley’s Sustainable Signals Report, 78% of asset owners are reported to want their investments to align with the United Nations’ Sustainable Development Goals. With Fintech’s ability to bring financial inclusion and services to millions of people across the African continent, its popularity among investors worldwide is on the rise.

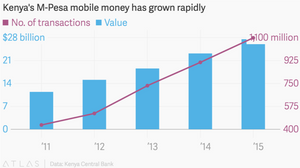

While Kenya’s M-PESA commanded early conversations of Fintech in Africa, there are many other emerging markets around the world that shape our modern day economy into the heterogeneous mixture it is. These emerging markets are so significant to our economies because they allow us to see what the banking system would look like today if built top-down in our modern world. It is important for developed markets to study the trends of those emerging in order to look to the future and plan their next implementations.

I am CPO and Co-Founder of Cred. Cred is a disruptive WealthTech startup aimed at enabling financial advisors and institutions to truly personalize each of their retail clients’ portfolios, based on their unique backgrounds, financial situations and preferences. This is the way investing will work in our generation, and we’re excited to be pioneers on this journey.

Feel free to contact me at ilan@credinvest.co, and find us on Facebook and LinkedIn!

A special thanks to Isabella Soffer, Miranda Wolford, David Minn and Jessica Edelman for preparing this article!